[GUEST CONTRIBUTION]

First: I don’t think much of cryptocurrencies. There are more than enough reasons for that, starting with energy consumption. To be honest, I also don’t believe in speculation of any kind. I have a deep-seated aversion to all actions in which people try to create money out of nothing. I didn’t know TeDeFi or TEFI-Token at all. So it happened that the casual question of one of my oldest friends in the chat, whether I would do „crypto stuff“, first made me want to start the usual rant.

But I’ve had this discussion with him too often in the last few years, so the answer was „No, you know that“. I added that the only cryptocurrency I hold is a trivial coin called EMC2, which he once gave me in a homeopathic dose when there was a brief hype about it many years ago. That was the end of the subject.

At least that’s what I thought. But eight days later, I make a mistake that would affect my following week in an unexpected way: my curt answer „yes“ to a popping question ends up with the wrong person, namely said friend.

Inhalt:

As a crypto millionaire on an island

Hours later, I had long since noticed the mistake, a digital „Yes?“ echoed back to me. I clarified the mistake. Since I had seen a recent picture on his Instagram channel with the Acropolis in the background, I asked if he was staying longer in Greece again, as he had so often in recent years – and how long it would take this time. „Stuck in Athens, the ferries are on strike. And then I’ll stay until I’m a crypto-millionaire.“ I countered the obvious joke accordingly by asking how long that would take. To make a long story short: It soon turned out that his joke had a surprisingly serious background.

In fact, he had invested the ridiculous sum of 100 dollars in some crypto crap over the last three to four weeks and doubled his investment every three days by simply gambling with price fluctuations. Not only had he made a profit of more than $30,000 in the process, but he had actually cashed out just under a third of it. As someone who, through his youth with bits and bytes, has absorbed the principle of exponential growth with his mother’s milk, I suddenly become alert.

If all his money had still been in this dubious crypto stuff, I would have thought something like „You only have what you really have.“, but in fact everything worked out here and continued to work out. He had some money all real and was happily trading on the rest of his winnings there, on the side, while we were texting. My first thought is, whatever this is, it can’t possibly last long, regardless of what any crypto-nerds are rambling on about. It can only be a Ponzi scheme.

He also assumed that the probability of it being one of the myriad scams was huge. But he was already a real winner in the scheme. Losing $100 for a chance to exponentially increase the stake? Just as he had done, surely I too could simply take out the original $100 as soon as I made a small profit. With exponential growth, the expected profit would only be delayed by a few days. If the $100,- is gone, and I saw this danger as damn high, it is still justifiable for the small sum. However, I wouldn’t dream of putting any serious money into it.

I would just have to be ironclad and spend all available time trading at short notice. Because the price is updated every 10 minutes, he had even set his alarm clock to ring every 18 minutes. That way he never missed a price reading. In other words, he hadn’t had any real sleep for more than three weeks and shouldn’t really be sane.

This didn’t really deter me as a self-employed person with my completely off-track sleeping patterns. On the contrary, it made it more plausible how he could manage in a short time to catch almost every opportunity to increase the token, which had additionally been rising robustly for weeks.

After all, the additional growth averaged 120 percent per month. Which sounded like complete nonsense to me, of course, but when there are numerous believers, it can happen. The main thing is that I don’t miss the jump. Darn it! I really thought about doing it, even though it goes against my self-imposed principles.

Research on TeDeFi and TEFI-Token

The next day I had my first closer look at what it was all about. The TEFI token of the TeDeFi Network. Aha. This thing is a bot for Telegram, that’s terrible. I quickly found something with Google. What can I say, I don’t give a shit, to say the least. Why, for what and wherefor? Babble. In the end, they just want to earn money with it and babble preconceived rubbish for it, similar to most professional artists when they explain their works to gullible morons. So I don’t even really skim over it.

Their website is much more interesting. What’s that? Spartan, but that’s the trend these days. As many pictures as possible and as little information as possible, preferring to work with large and easily digestible text blocks. Plus the obligatory roadmap as a graphic.

Something for everyone!

The team – unbelievable – the surnames shortened to the first letter? Very dubious!

The photos, something for everyone, from nerds and hipsters to sportsmen and people I would expect to see in a shisha bar. Start-up stuff. But I couldn’t care less. More important was: Are they for real? There is no imprint and no address details or even a business form. The links under the photos lead to some social media profiles, but that doesn’t mean anything. Oh, some social media icons are not linked at all.

Under „Partner“ it says who they claimed to be supported by. Fine, I don’t know the crypto stuff anyway, so it doesn’t really help. But I thought I’d have a look anyway. The links under the supporters‘ logos lead to articles about the TeDeFi Network, which are apparently all paid promotional articles. Very confidence inspiring. I assumed there was a 75 percent chance that this was more than dubious anyway, but of course I would have preferred to be pleasantly surprised.

My approach was to apply the principle of „gaming the system„, so to speak, by deliberately taking the chance that there might be dishonest intentions here for the people behind this project, and try to take advantage of the offer while I still can, and then hopefully pocket my profit in time before they might end up disappearing with most of the investors‘ money, if it is a scam.

Tax?

Fundamentally important before making such a decision: how should I actually pay tax on my profits? After all, I am not a scammer. Aha, okay, like private sales transactions. And log all my transactions universally. Fine, the decision was made, I was going to do it. Of course, my friend had to explain to me in detail how to get started because I’m not the least bit interested in all of those things.

Crypto fraud?

But before that, I found time to read up like a „Neuland“-newbie on a website about „How do I recognise crypto fraud? What can I say? TeDeFi scored a pretty clear hit on the warning sign checklist every time, in my opinion. In fact, I was more pleased than put off by this because my intuition seems to be reliable. I was hooked anyway!

First I had to deposit money on Binance, the largest crypto trading platform in the world, and convert it into BUSD which are linked to the dollar exchange rate. If you want to be creeped out, you should read the Wikipedia article on Binance first. I’m just saying, for the US they supposedly have to offer a different platform and SEPA transfers are no longer allowed for them.

To be honest, I would normally only trust them with my money if there was no other way. There is a reason for the motto „Not your keys, not your coin!“ But it helps immensely if you first check out Binance, similar to a cold shower before jumping into a swimming pool, before transferring your money to a Telegram bot of all things!

Positive surprise!

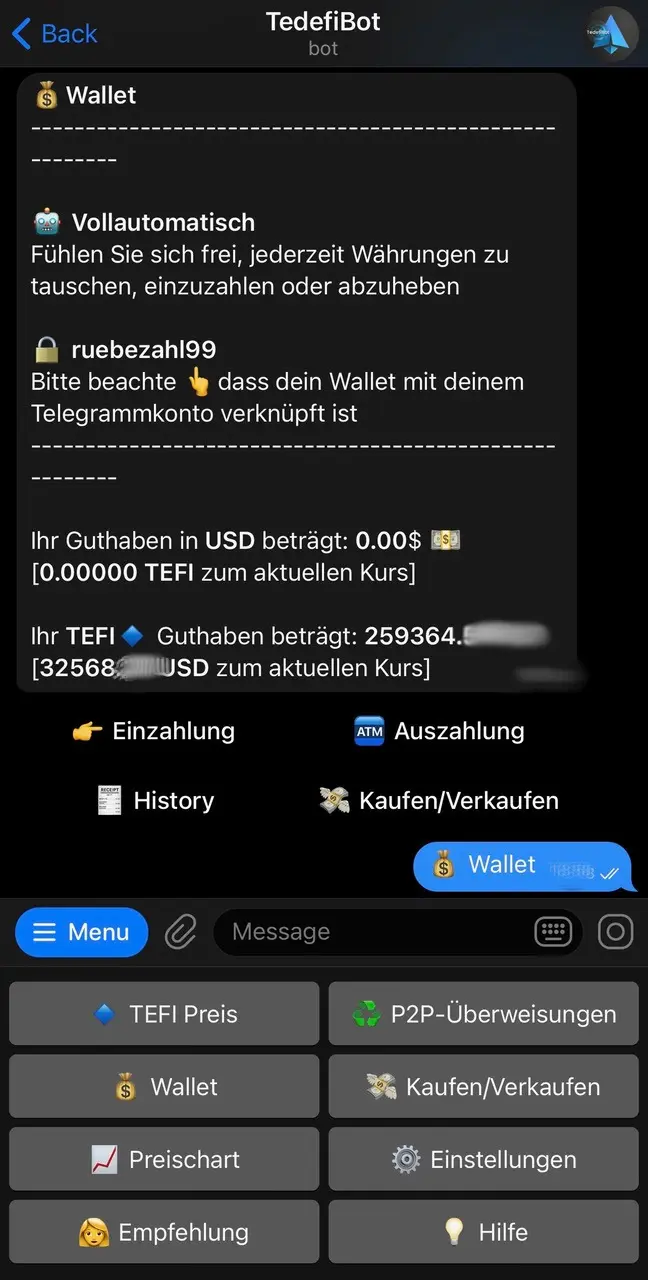

So now I really got into it and invested real money in a windy chatbot of unknown origin. If someone had told me this two days before, I would probably have laughed at the person. But in fact, the bot surprised me positively. It may look as if it was cobbled together by dilettantes, but it is pleasantly intuitive and easy to use. For fools, so to speak. But I want to avoid drawing any conclusions about the target group from this. Trading is even fun and can actually be entertaining and very exciting.

You can sit comfortably in front of the computer for hours and trade away, the price usually only changes every ten minutes. Buying and selling TEFI does not cost any fees. The people behind the TeDeFi Network earn a lot from the strongly rising price, as 15 percent of the limited tokens are reserved for the team. Gambling with the price fluctuations actually worked as effectively as hoped. Brave new world. I found myself thinking that it would be a dream if you could earn money like that.

Parallels to the LUB token scam?

Along the way, I kept reading the German– and English-language Telegram chats on the topic to find out whether they also thought the whole thing was fraud. Warners there liked to draw comparisons to the LUB token scam, which was also based on a Telegram bot and where after a supposedly successful phase one day there were no more payouts. It was extremely frightening to see in these chat groups how much people can talk themselves into things. Warnings of this kind are often not taken seriously. Instead, people prefer to believe the most absurd but positive-sounding arguments against a scam, raise the mood with animated memes and rant about some haters who allegedly want to create a counter-mood for personal reasons.

Greed eats brains?

Yet some indications of the seriousness of the situation are anything but mood-mongering. For there were also screenshots of a chat with BTC-ECHO, which had previously withdrawn an article sponsored by TeDeFi because the editors were worried that it could be a scam and now wanted to check this in detail before the paid article, i.e. the advertisement, went back online. To date, the article is offline.

I have to say that I find it pathetic that most other websites in this industry seem to give a damn about the welfare of their readers and prefer to make money with ads from conspicuously dubious providers. In this scene, greed eats brains and morals come last for most investors and media, it seems. BTC-ECHO seems to be one of the positive exceptions here.

Other warnings that set off my inner alarm bell included the rumour that the applications for a listing at CoinMarketCap and CoinGecko announced by the TeDeFi Network had allegedly not been submitted at all. This rumour was substantiated by a screenshot of a chat with CoinGecko, but later refuted by a response from CoinMarketCap that was deliberately kept very non-committal, at least for CMC. Nevertheless, my intuition told me that the listing date could be a time for the potential end of TeDeFi, if this token was indeed a scam. Two days later I was to find out how correct my gut feeling was, although I actually have no idea about the matter.

At second glance

Meanwhile, I had gambled myself silly a few times in an overtired state and inadvertently put the handbrake on the growth of my TEFI tokens. Moreover, there was a night phase where there was simply no meaningful opportunity to trade. The fun had evaporated and turned into a tiresome wait.

Bored, I started trying to find out more about the makers behind TeDeFi. First, I gave their website a much more intensive second look. Europe and California have strict data protection laws, if you are targeting EU citizens or Californians with your offers, as the TeDeFi network demonstrably does, e.g. through the German-language translation of the Telegram bot, then there must be a link to the data protection agreement. But the site has no privacy policy at all, that could be immediately warned off. It is very unlikely that a serious team, which supposedly includes a German, would make such a negligent mistake that could result in severe penalties. Especially not after everyone has been talking about the GDPR, and it has made waves all the way to the USA.

The same applies to the page of their main company, which is called P2blockchain. Here, too, although the page is even clearly aimed at other companies, no company form, address, telephone number or privacy policy can be found. At least: On the TeDeFi website, there is a link to the TOS in the cookie banner. The terms and conditions are ridiculously brief for a company that offers financial transactions. I am not a lawyer, but I still think I can judge that this is not sufficient for such a company.

The domains are registered with special privacy providers who are supposed to protect the identity of their clients. Why does a service provider that wants to offer blockchain solutions to its potential clients need Dynadot, the same service provider as Wikileaks, to hide its identity?

Who are they?

On the team’s Linkedin profiles, one can see that P2blockchain was probably founded in 2018. This is also when the domain was registered. On archive.org’s WaybackMachine, however, the first archived entries for p2pblockchain.org can only be found from November 2021.

When searching for p2pblockchain, one finds a telephone number under callupcontact.com, as well as an address at 4184 Pike Steet in San Diego, California, the entry clearly refers to p2pblockchain.org. However, the street in San Diego does not exist.

There is no shortage of coverage about TeDeFi on the net, at least one would think so, but most of the articles are marked as ads, i.e., bought. Honi soit qui mal y pense. In general, you can find almost only free hosted pseudo websites on the net about P2blockchain, which are obviously used to feed search engines with very similar texts about the company that are supposed to inspire confidence. Very funny is the address information on one of these pages: 123 Sesame Street, Suite 101, New York.

The domain tedefi.com was registered in July. If you take a closer look at the team’s Twitter profiles, you will notice that all these profiles only started to be active in June or July 2021. That is, at the time when the TeDeFi domain was registered. However, the profiles have been registered on Twitter for much longer, and I immediately thought of profiles bought from dubious sources for dishonest purposes.

The profiles of Artem Shirokov and Jeremy Merrell, however, still have an older tweet with a strange text that doesn’t really make sense. Very striking: Both tweets [1] [2] were written on the same day at almost the same time, 6 February 2021, shortly after 02:00. The thought of a short test of purchased profiles came to my mind. Furthermore, suspicious is the activity of the profiles on LinkedIn, each of which also began only a few months ago. None of this can be glossed over any more.

No one on the team has had a skill confirmed by anyone else. The professional careers of the team members seem to be limited to universities and later self-employment. The two exceptions are Jeremy Merrel and Shawn Cassady,

Jeremy lists his former employer as a subsidiary of Dell, which has over 10,000 employees. If someone were to simply claim this, it would be quite unlikely that anyone would ever notice this fake, given the high number of employees.

What’s funny is Shawn’s former employer. TeDeFi’s brand designer was formerly a senior brand designer at Studio One Twelve for three years. The LinkedIn entry of this company linked on his profile is not very informative, in fact there is a hair salon of this name at the address given there. The link leads via redirects to some China rubbish. Let’s hope that the man used to work for another company with this name.

Even with Google, I can’t find anything about the members of the team that could dispel my doubts. At least, none of the findings can be clearly assigned to one of these persons. For example, you can’t find an entry if you specifically search for “Berlin” and “Marko Schreiner”. This name simply does not appear in connection with Berlin.

However, there is another Jeremy Merrel, who also comes from Houston and who has a profile on LinkedIn. There are countless entries about him, which makes the search much more difficult.

Sebastian V., well, as far as he’s concerned … he probably didn’t have enough for a social media profile, so there’s not even a surname for further research. On Twitter, by the way, there is a user called p2pblockchain. Very active, but apparently he has nothing whatsoever to do with the company P2Pblockchain and TeDeFi.

I’ll play it safe

Although this looks obvious to me, I was still unsure after this research. Am I too conservative to want to know who I’m investing money with? I then withdrew my stake a little earlier than originally planned, which worked out smoothly. The reason for the hurry was my intuition about the listing on CoinMarketCap mentioned above.

A brief investigation into the LUB token scam revealed that all payouts stopped around the expected time of the CMC listing. Since the listing of the TeDeFi Network was imminent, I feared that this could also be the case if something was indeed wrong here.

Despite all my doubts, I left the winnings in the system as play money. Greed eats brains also applies to me. But with only about 35 dollars, it now takes far too long to quickly achieve a lucrative rate of increase in my silly crypto assets, so unfortunately it’s not worth the time investment. Every day the probability increases that either a bad end will follow or the token could become significantly less profitable. I probably got in a week or two too late.

Besides, with staking looming, the next step would be ideal to make off with the money.

Panic breaks out!

A few hours after I had secured my money a real panic broke out in the TeDeFi chats because the payouts failed to materialize and the support didn’t respond for hours. Since I wanted to see with my eyes that the worst had happened, I tried to see if I could withdraw the rest of my money. Of course, that didn’t work for me either. There was no question that I saw all my doubts confirmed and couldn’t believe my luck at having saved my money at the last minute. An action like something out of a picture book. But having actually lost my winnings still left me with a sour feeling.

Payouts delayed

TeDeFi support got back to everyone on Telegram chat the next day, asking for patience and claiming that the payouts had been delayed due to maintenance while they were preparing for staking, but that they were now being processed and would be paid out gradually. I thought this was just a stalling tactic, but was amazed that they even bothered to get back to their supposed victims. When the first people reported in the chat that they had received the payout, I still doubted it. Because they could all be fake profiles. When I actually received the payment in Binance, I raised my left eyebrow in fascination and stared at my inbox in disbelief.

Nevertheless, I am not convinced by the payouts that have been made. Part of the strategy of a good scam is to lull its victims into a sense of security with tricks. A good scammer would do exactly that. Trigger a brief panic that quickly dissipates because it was unjustified. This increases trust, because after a severe scare, even simply keeping one’s word has a confidence-building effect. For amusing, grandiosely audacious deception strategies, I recommend watching the series Sneaky Pete((Werbung/Advertising)) and Better Call Saul((Werbung/Advertising)). Unfortunately, I don’t have time for that, because of course I immediately paid the 35 dollars back to the Tedefi bot, because I’m hooked and greed eats brains.

Conclusion

It remains exciting: when, how and if? Of course, I can only advise everyone to keep their hands off this kind of stuff, unless you want to burn them. Is the TeDeFi Network a scam or not? The answer to that question is up to each individual at this point. But whichever way it turns out, they’re either an incredibly unserious team that breaks a lot of fundamental rules, or they’re damn bad scammers. Either way, they should try harder in their public appearance. Although things still seem to be going amazingly well for them in both cases.

Well, your suspicions were confirmed tonight – 03 Jan 2022. Tedefi came to a very abrupt and sudden halt. All payouts stopped… no withdrawals. Then the value dumped from $0.20450 to $0.009 in seconds. Panic broke lose on the Telegram chat channel and everybody realized they have been scammed… with STILL the exception of a few who claimed „its only a glitch – buy the dump“. I lost $1500.

Did I learn something? Yup… if something seems off, it probably is off… use common sense and follow your gut, damn it! My first concern was alerted when they did not honor their promise of giving the reward of 88 $TEFI tokens for referrals. Then they would not budge to give an AMA. And then the withdrawal issues started. I investigated their websites like you did and also noticed the lack of real identification of any sort. I also checked out their social media profiles and realized it must be fake. I learned a very valuable lesson… don’t be so gullible… McFly!